How to register your business with the Bureau of Internal Revenue (BIR) in the Philippines? After securing a certificate of registration from the Department of Trade Industry (DTI) for single proprietorship, Securities and Exchange Commission (SEC) for partnership and corporation, and after obtaining a Mayor’s Business permit with the Local Government Unit (LGU), your next step to operate as a duly registered business is to secure a certificate of registration from the BIR.

Registering your business with the BIR will give you the authority to print your official receipts and other invoices, provide you or your corporation a Tax Identification Number (TIN) and register the books you will use to record your business transactions. Furthermore, your BIR certificate of registration will state the types of taxes you will pay, such as business taxes, withholding taxes and income tax. The following are the requirements and steps to register your business or company with the BIR.

For single proprietorship

1. Accomplish BIR Form 1901 and submit the same, together with the required attachments, to the Revenue District Office having jurisdiction over the registered address of the business establishment. The following are the forms and requirements to be attached with your application:

a. BIR Form 1901 – Application for Registration

b. Birth certificate or any valid identification showing name, address and birth date

c. Mayor’s permit or application for Mayor’s Permit

d. Department of Trade and Industry (DTI) Certificate of Registration of Business Name (to be submitted prior to the issuance of the BIR Certificate of Registration (COR)

2. Pay the Annual Registration Fee (P 500.00) at the Authorized Agent Banks of the RDO.

3. Pay P 15.00 for the Certification Fee and P15.00 for the Documentary Stamp Tax (in loose form to be attached to Form 2303).

4. The RDO shall issue the Certificate of Registration (Form 2303).

For partnerships and corporations

1. Accomplish BIR Form 1903 and submit the same together with the required attachments to the Revenue District Office having jurisdiction over the registered address of the business establishment. The following are the forms and documentary requirements to be attached with your application:

a. BIR Form 1903 – Application for Registration for Corporations/Partnerships (Taxable/Non Taxable)

b. SEC “Certificate of Registration (Certificate of Incorporation/Certificate of Co-Partnership) or “License To Do Business in the Philippines” in case of resident foreign corporation

c. Mayor’s Permit or application for Mayor’s Permit – to be submitted prior to the issuance of the BIR Certificate of Registration

2. Pay the Annual Registration Fee (P 500.00) at the Authorized Agent Banks of the RDO.

3. Pay P 15.00 for the Certification Fee and P 15.00 for the Documentary Stamp Tax (in loose form to be attached to Form 2303).

4. The RDO shall issue the Certificate of Registration (Form 2303).

5. Taxpayer must pay the Documentary Stamp Tax on the Articles of Incorporation as prescribed under Section 175 of the NIRC, on the 5th of the month following the date of issuance of said article (per RR 4-2000).

Further steps following the registration

1. Apply for Invoices/Receipts using BIR Form No. 1906 – Authority to Print. The BIR will give you an “Ask for a Receipt” Notice (ARN) together with the COR BIR form 2303, and it must be posted conspicuously in your business establishment.

2. Register books of accounts (Journal / Ledger / Subsidiary Income Book and Subsidiary Purchases/Expenses Book) and have them stamped by the RDO where the business is registered. The BIR examiner will usually advise you the types of books and taxes applicable to your business upon briefing.

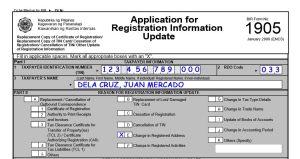

3. Update registration information, if needed, using BIR Form No. 1905 (change of registered address, personal exemptions, additional tax types, etc.) Submit this at the RDO having jurisdiction over the place of business

Notes: Thank you Mam Rinna, Mam Soc and Mam Chi for assisting me all throughout my application process. (RDO 25B located in Sta. Maria Bulacan)

Credit: businesstips.ph